Knowing Your Numbers

Cafe

4 mins read

If you’re running a business you need to know and understand your numbers; this means knowing exactly where your revenue is coming from and every one of your costs.

Quite simply, if you don’t know your numbers you can’t manage them.

Mastery of your numbers almost guarantees an increase in profit, as it will shape your decision-making and focus your attention in the right areas.

Revenue

It’s quite easy to see how much money is coming in, but you also need to know where it’s coming from in terms of what items are selling, which aren’t, who’s purchasing, and what time and day of the week your customers are buying.

This knowledge will help guide your menu design, staffing levels, and marketing, amongst other things.

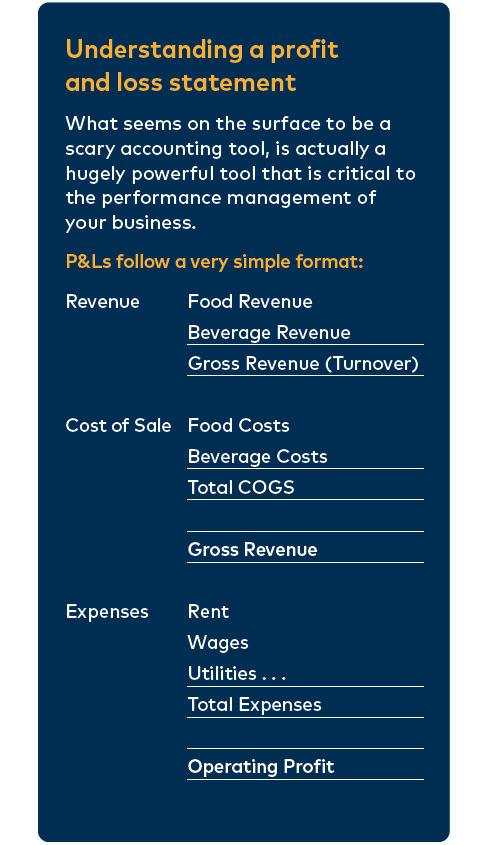

Most POS systems will provide a great suite of sales reports to help you better understand where your revenue is coming from however you’ll also want to make sure you’re generating a robust profit and loss statement (P&L) every month to give you a really good snapshot of your business’s performance.

Understanding a profit and loss statement (continued)

At the top, your revenue streams are listed. It’s critical that you separate your food revenue from your beverage revenue; if these are lumped together you cannot track your food costs. These revenues combined are your gross revenue or turnover.

It’s important to note that GST must be stripped off your revenue as it should not be included anywhere in your P&L.

The next section is your cost of goods sold (COGS). This contains all of your variable costs associated with the sale of a menu item, normally the food costs and packaging.

The difference between your revenue and COGS is your gross profit.

The next section of the P&L lists all of your expenses, which for the most part are fixed costs, such as rent, wage costs, staff expenses, utilities etc. Subtracting all of your expenses from your gross profit will give you your operating (or pre-tax) profit.

Be careful here, your operating profit will also not include things like depreciation and interest on lending.

Food Costs – There are two types of food costs: theoretical food costs and actual food costs. Both are really important to know as the difference between the two will be the best place to look for cost savings.

THEORETICAL FOOD COSTS

Each and every item on your menu must have their food costs calculated. This involves measuring, to the gram/ml, each recipe ingredient and working out the cost of that measure. The combined cost of all of these ingredients is your food cost and is one of the most important metrics involved in managing the financial performance of your business.

Food costs can be worked out by using a simple spreadsheet and/or loading them into one of the various apps available online. Some POS systems even offer food cost capabilities.

Make sure you are calculating your food costs without GST included. It’s important to take into account seasonality when working out your food costs, as the price of fresh produce can change drastically over the course of a year.

The simplest way of dealing with this is to either average it, or inputting the highest amount that is viable for you to pay without eroding your margin.

By keeping a close eye on your invoices; once the cost of an ingredient increases above what you can afford, it’s time to change the recipe or remove the item from your menu until the price drops again.

Food Costs - Continued

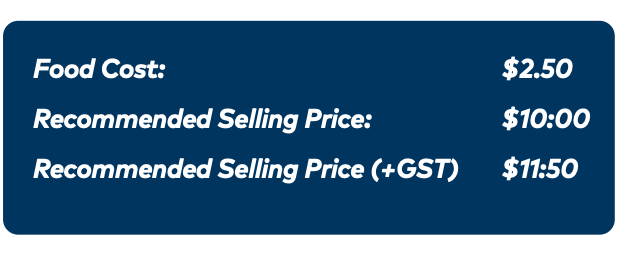

Your theoretical costs, once known, can be used to work out your sale price. Everything you sell should be four times your food cost excluding GST. GST can then be added on at the end as per the example below:

Expenses

WAGE COSTS – Study your wage costs carefully and make sure that your BOH and FOH labour combined is less than 28-32% of your turnover.

Wage costs can sneak up easily and before long become the accepted norm. Remember that every man-hour you can save from your wage costs will give you an additional saving of around 12% by way of holiday and Kiwisaver costs.

EXPENSES – Like your wage costs, other expenses in your business can sneak up on you. Having visibility of each expense will help you stay on top of them. It’s recommended that you schedule a time to periodically review all of these expenses every year.

Work through every line item in your P&L and don’t be afraid to shop around for the best deal with utility and service providers.